Contracts might be essential, but they also consume time, money, and resources. Unforeseen risks can drive up legal costs, create costly delays, and drain your team’s focus. This makes strategic contract risk mitigation an investment rather than an expense.

Too often, discussions about contract management risks get stuck in the realm of problems and fearmongering. This blog post is about solutions. We’re going to delve into seven concrete ways to minimize the risks lurking in your contracts.

Whether you’re concerned about compliance issues, unexpected liabilities, or damaged business partnerships, these strategies aim to put you back in control.

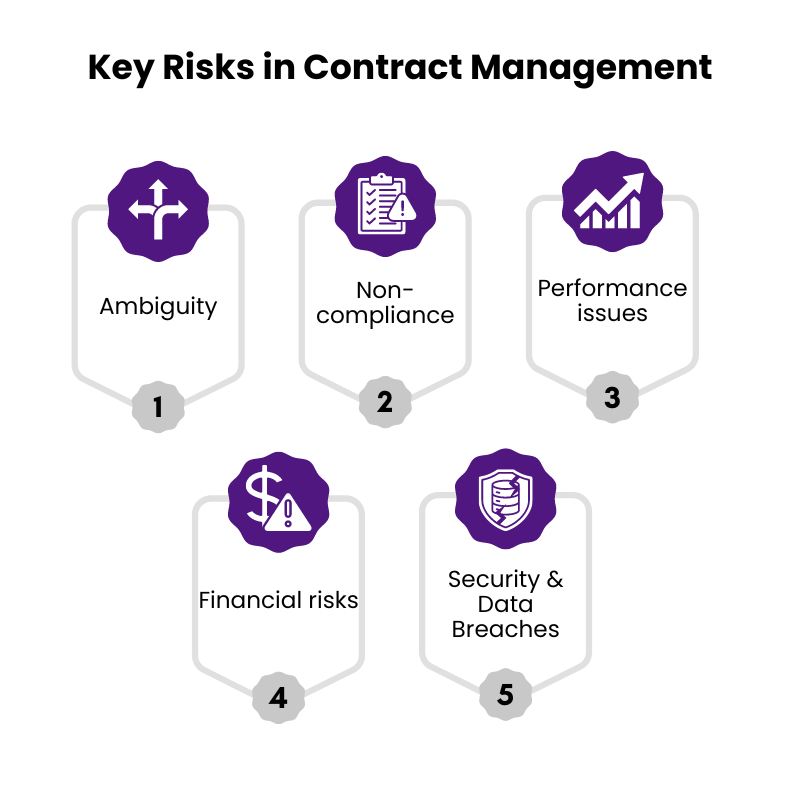

1. Identify and Analyze the Types of Risks in Contract Management

The first step in effective risk management in contracts is to be aware of the common dangers. Here are some key types of risks in contract management:

- Ambiguity: Contract language that’s vague or open to interpretation increases the likelihood of misunderstandings and disagreements later.

- Non-compliance: Failure to abide by contractual terms, laws, or regulations can lead to penalties and damaged relationships.

- Performance issues: Delays, service quality problems, or unmet expectations by either party can strain a contract.

- Financial risks: Unanticipated expenses, currency fluctuations, or unexpected liabilities can erode profitability.

- Security & Data Breaches: Insufficient protection of sensitive information in contracts can lead to data breaches and privacy violations.

Perform a thorough contract risk assessment to determine the specific risks that are most relevant in your organization’s context.

2. Standardize the Contract Creation Process

Creating consistent, predictable contract terms and conditions fosters efficiency and lessens the chance of errors. Implement the following standardization measures:

- Pre-Approved Templates: Develop templates for different contract types, ensuring they include essential clauses and address common risks.

- Clause Library: Establish a repository of standard and most common contract clauses (e.g., termination, limitation of liability) vetted by your legal team.

- Clear Approval Workflows: Outline the steps and personnel required for contract drafting, review, and approval.

3. Implement Role-Based Permissions and Access Control

Establishing safeguards around who can access and edit contracts is a critical step in how to mitigate risk. Set up a system with these features:

- Security and Confidentiality: Protect sensitive information by restricting access based on user roles and needs.

- Audit Trail: Maintain a clear history of contract edits, approvals, and access for compliance and accountability.

- Encryption: Safeguard sensitive data, especially when stored or transmitted electronically.

4. Centralize Contracts in a Secure Repository

Scattered contracts make it difficult to track obligations, expiration dates, and potential risks. Here’s how centralization helps:

- Unified Storage: A dedicated platform provides a single source of truth for all current and past contracts.

- Enhanced Visibility: Easily search contracts by metadata (e.g., vendor, contract type) for better risk oversight.

- Streamlined Collaboration: Multiple stakeholders can access and work on contracts simultaneously, leading to better alignment.

5. Automate Key Contract Lifecycle Processes

Automation streamlines routine steps in the contract lifecycle, helping avoid errors and bottlenecks that heighten risk. Consider implementing:

- Notifications and Alerts: Set automatic reminders for renewals, expirations, and critical milestones to prevent costly surprises.

- Approval Flows: Define workflows to ensure contracts receive proper approvals and eliminate unauthorized actions.

- Reporting and Analytics: Generate reports to track contract performance, compliance, and potential risk trends.

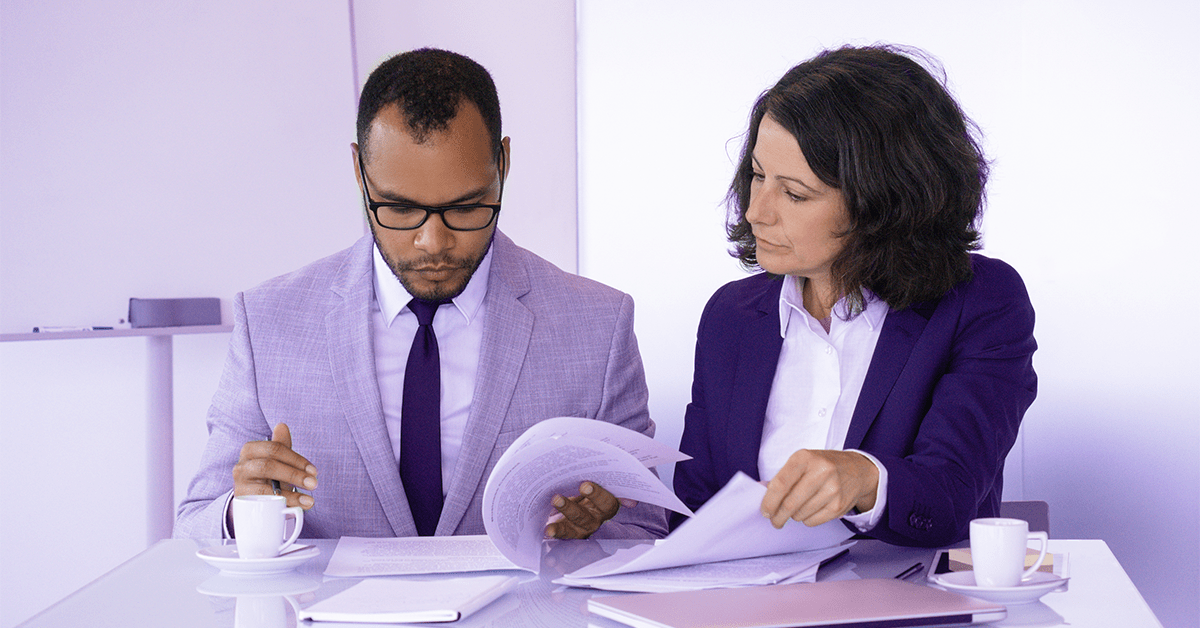

6. Prioritize Ongoing Review and Monitoring

Contract management is not a ‘set it and forget it’ process. How to mitigate contract risks effectively requires periodic reviews:

- Key Performance Indicators (KPIs): Establish metrics to track performance against contractual objectives.

- Market Conditions: Monitor any external changes in regulations, market rates, or other factors that could influence the contract and its risk profile.

- Relationship Management: Maintain open dialog with all contract stakeholders to proactively identify any potential issues.

7. Embrace Technology with Contract Management Software

Managing contracts manually with spreadsheets and email trails is cumbersome and prone to error. Consider investing in contract management software, which offers advantages like:

- Intelligent Search: Retrieve contracts based on key terms, making it easier to identify risk patterns.

- Data Analytics: Uncover trends and predict potential issues for proactive adjustments.

- Streamlined workflows: Improve efficiency and compliance while reducing administrative overheads.

- Collaboration Tools: Foster smooth interaction between internal and external stakeholders involved in the contract process.

Contract management risk mitigation is an ongoing investment that protects your business from financial losses, legal disputes, and reputational harm.

By implementing these seven strategies, you can strengthen your contract management processes and set the foundation for mutually beneficial collaborations.

Remember that vigilance, proactivity, and a dedication to continuous improvement are essential ingredients for successful contract risk management. By effectively addressing risks in your contracts, you’ll be well positioned to achieve your business objectives securely and successfully.